In a ranking of the top ten companies by market cap in robotics, one won’t find Europe’s ABB Robotics. A list from GlobalData of the technology companies leading in robotics is, as one might expect, led by Microsoft at $2.5tn, ahead of Alphabet, Amazon and Tesla who command figures on a scale between $1.9tn and $1.1tn in the robotics market.

Samsung, Toyota and Alibaba are also on the list with figures in the $100bn range. Beyond those are smaller names, including ABB Ltd: but nonetheless the company is one to keep an eye on, for investors following and trying to understand the growth of robotics this decade.

Founded in 1988, the Swiss automation giant is no trendy disruptor. Nor is ABB grabbing the headlines for announcing humanoid robots as Tesla has, or for having a household name CEO like Gates or Musk, instead sitting somewhere in between the two extremes.

With a market cap of over $70bn, the company may nonetheless be said to punch above its weight due to its diversity. A recent GlobalData report on robotics considers the company to be a leader in the types of robotics leading most investment today. Clients for ABB Robotics can be found in a variety of sectors, including manufacturing, healthcare, construction and auto.

ABB's last annual report gives total revenue of $2.9bn for its Robotics and Discrete Automation arm. The company's quarterly financials for Q3 2021 also report both ABB's Robotics and Machine Automation divisions increased orders strongly at over 20% year on year (YoY).

ABB also ranks highly in the GlobalData scorecard for industrial automation, coming in second to Microsoft and beating the Redmond-headquartered giant with a perfect score of 5 in both robotics and industrial internet themes. Microsoft holds a 4 in both areas alongside the digital twins theme, for which ABB holds another winning 5.

These scores represent GlobalData analysts’ assessment of the competitiveness of each company regarding a particular theme. They are then weighted based on their importance and used to create the final industry ranking in the scorecard.

ABB ranks high not only in hardware but also software for robotics, being the rare kind of incumbent that is willing to change the paradigm. Such a change is part of the future steer in robotics into more intelligent realms, as Verdict will reveal.

“ABB is one of the key players in the ‘factory of the future’ space,” explains Filipe Oliveira, senior thematics analyst for GlobalData. “We forecast industrial robots to be one of the fastest growing segments within robotics and ABB is a key player in that segment, being one of the ‘Big 5’ in industrial robotics.”

The robotic future of work

In Oliveira’s robotics report, the future of work theme looms large, noting increasing concern that automation, of which robotics is an important component, will lead to increased unemployment.

Robotics is already impacting work by both changing production lines and, in some cases, replacing human workers. As each industrial robot of the sort made by ABB can replace several human workers, such unease is a legitimate cause for concern.

Nonetheless, GlobalData argues the impact of robots has been a positive one. In Japan’s care homes, robots reduce the need for night shift nurses, freeing some workers from working unsociable hours and addressing a staffing shortage in the sector. Liberating human workers from doing dangerous, repetitive or unsociable work is “a positive development, particularly if the economy can create higher-value jobs for those workers that robots have replaced.

“It is not yet clear that that will always be the case,” GlobalData adds, though.

ABB Robotics in Asia

According to the International Federation of Robotics, South Korea has the second-highest density of robot workers globally, second only to Singapore and ahead of Japan and Germany. South Korea also had the world’s lowest fertility rate in 2020, with Japan and Germany not far behind. Thus, if automation presents risks to labour, robotics can also help address future shortages in the workforce.

Patents in robotics also point to the future of work. In 2020, 4 million robotics patents were granted across all geographies, which compares with 1.2 million patents granted in 2010. Most leading companies in robotics patents are based in Japan, China and South Korea.

Japan, like Korea, has a low fertility rate, so perhaps it’s no coincidence that Japanese companies dominate the top 10 leading patent assignees. Likewise, it’s no surprise ABB has a footprint in Japan and surrounding East Asia, with 17 branches in Japan, 11 in South Korea and a grand total of 34 in China.

With six more offices in Taiwan, ABB’s East Asia presence numbers 68, making the region the company’s second biggest territory behind Europe. As a comparison, North America, its third biggest territory, has 62 ABB locations as of November 2021.

While not all these ABB operations may deal with robotics, it is clear which paths the European company is following for its riches. In its Q3 2021 report, ABB notes all regions improved at a double-digit rate last quarter in robotics, with the Americas and Europe outpacing the AMEA region, including China orders up by 17% (10% comparable) YOY. The robotics boom marks ABB's highest growth in China for Q3, with more subdued figures in the Middle Kingdom for its electrification and motion segments.

The factory of the future

To understand the future of work one must picture the factory of the future, which ABB is helping to create with the building blocks already evident today.

Robot technologies such as co-bots and logistics robots are coming together to turn factories into advanced engineering labs where assembly line processes and components are constantly analysed, streamlined and improved.

Co-bots are industrial robots designed to work alongside humans on specific tasks, while warehouse robots and delivery robots are leading examples of logistics robots. These autonomous devices are capable of transporting goods with limited assistance of the human sort, and are a very profitable branch of the service robot market.

In GlobalData’s view, the demand for automated production has increased in the age of Covid-19, leading to another bump in the growth of robotics.

“Companies like ABB, KUKA and FANUC have benefited from increased demand following the pandemic and ABB launched two new robotic arms in 2021,” says Oliveira.

Future financials in robotics

As countries and companies attempt to recover from the pandemic, interest in robotics will increase. This is one reason researchers forecast the growth of robotics to reach a compound annual growth rate (CAGR) of 29% to $568bn. In 2020, the robotics industry was worth $45.3bn.

Annual growth rates in robotics will peak at 37% in 2024. Sales of industrial robots hit $14.6bn in 2020, equivalent to 32% of the total robotics market. By 2030, this segment will be worth $352bn, having grown at a CAGR of 38% between 2020 and 2030.

Meanwhile in M&A, there are three main areas driving robotics activity: medical, logistics, and industrial automation, with most transactions in those fields according to GlobalData research.

At $30.7bn in 2020, the service robot market was larger than the industrial robots sector. However, the industrial robots market, in which ABB is a leader, will grow faster over the next decade, which can only mean more good news for the Zürich-headquartered company.

ABB and AI robotics

Besides leading in the industrial and service spaces in robotics, ABB’s current and future success is also down to a third area in which it has pitched its flag, one away from the hard surface of clanking metal perhaps.

As GlobalData reports, ABB and other some traditional robotics players are opening up their platforms, encouraging "more open development around robotics and improved interoperability between systems."

This stands in hard contrast to the nature of the industry historically, where most of the software powering industrial robots is proprietary and closed, making it compatible only with systems from a single company.

This open sea change is driving the field of robotic intelligence, as more and more software specialists develop what are essentially robot operating systems (ROSs). This interoperability will become more important as more data is shared with cloud robotics platforms, allowing them to learn from a wider range of robots and develop better algorithms and control systems.

It will also see the growth of robotics intertwine with the growth of artificial intelligence, or AI. AI technologies, most notably machine learning, are integral to the development of intelligent industrial robots, which can anticipate and adapt to certain situations based on the interpretation of data derived from an array of sensors.

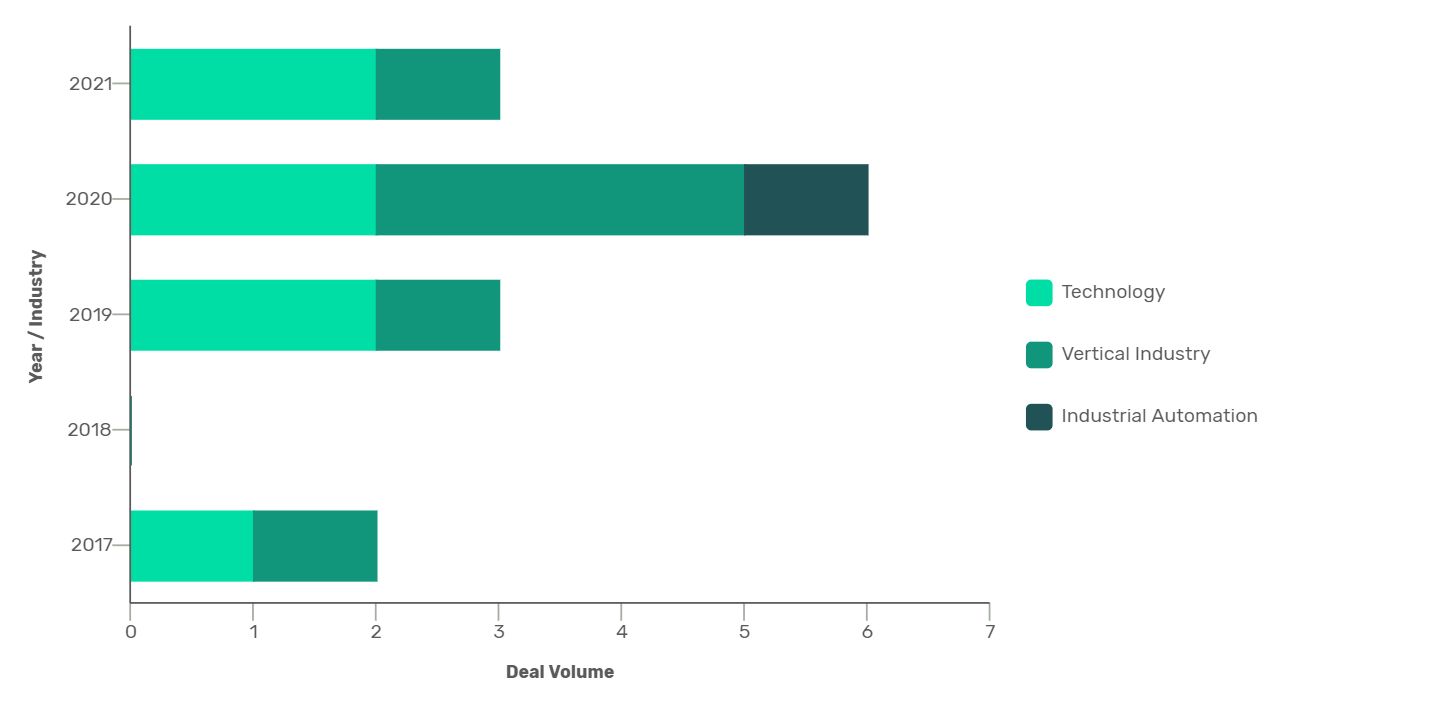

In February 2020, ABB partnered with AI robotics unicorn Covariant to bring AI-enabled robotics solutions to market for an undisclosed sum, starting with a fully autonomous warehouse order fulfilment solution. The deal was ABB's 17th to reach completion over the last decade, as illustrated by this graph from GlobalData research.

Covariant, one of GlobalData’s AI unicorns predicted to go public by 2023, stands out in the robotics field with its signature off-the-shelf universal AI for robots, known as the Covariant Brain.

Covariant, one of GlobalData’s AI unicorns predicted to go public by 2023, stands out in the robotics field with its signature off-the-shelf universal AI for robots, known as the Covariant Brain.

The rising investment in AI is a reason why companies such as Microsoft and Alphabet/Google lead by market cap in robotics. In GlobalData’s Industrial Automation scorecard, both Microsoft and ABB hold a perfect score of 5 in the AI theme. To jump from second place to the top spot currently held by Microsoft, analysts recommend ABB adds more focus to themes such as extended reality, wearable tech, cybersecurity and edge computing.

Microsoft though may have one advantage in robotics which ABB can’t feasibly compete with, and that’s in its formidable cloud capabilities.

“Microsoft leads in AI which is increasingly important in robotics,” explains Oliveira. “Machine learning is what is making them smarter.

"Microsoft is also a cloud provider and cloud computing has been a game changer for robotics as it enables robots to be connected and therefore learn from each other. Cloud also allows things like remote maintenance to take place.”

Looking at GlobalData’s database of M&A transactions in robotics, one can see a rise in themes related to robotics, including the future of work, industrial automation and AI. In fact, while AI M&A activity may have declined in 2019, it recovered in 2020 to reach the highest point of the decade with 109 M&A transactions in total.

For those looking for the alpha investment in robotics, it is clear AI holds the most promise this decade, and ABB is already ahead of the curve when it comes to smarter kinds of robots in the factory of the future.

Find out more in the GlobalData Robotics: Thematic research report and GlobalData’s Industrial Automation thematic scorecard.

This article is part of a special series by GlobalData Media on artificial intelligence. Other articles in this series include:

- The 12 companies leading the way in AI - Investment Monitor

- AI in healthcare: key highlights in 2021 - Pharmaceutical Technology

- Index shows US is winning the AI race – but for how long? - Investment Monitor

- Why is AI an obsession for business insiders? - Verdict