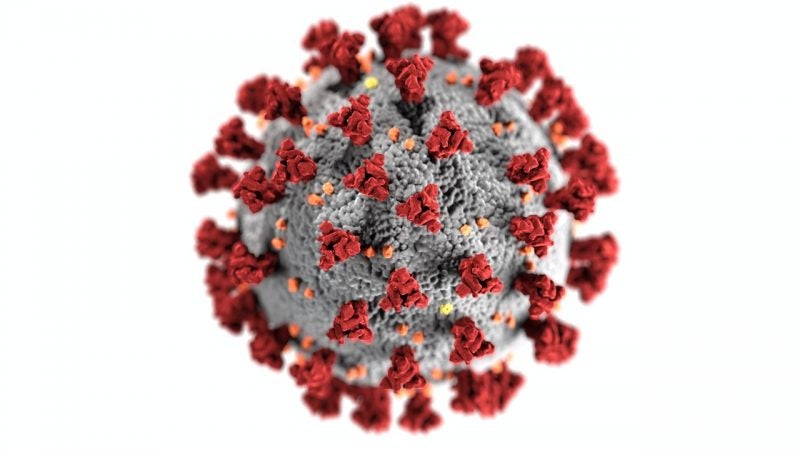

The Rail Supply Group (RSG), the leadership body for the UK rail supply sector, recently released the results of its study on the effects of the Covid-19 pandemic on the UK rail supply industry.

Carried out by independent market research organisation Savanta ComRes, the inquiry’s aim was to assess the impact of the pandemic on the industry, to understand in which areas companies need more support and to explore the barriers that need to be removed in order to achieve a complete recovery.

The research was carried out between 30 April and 18 May, with 442 people working in the sector taking an online survey. Researchers also conducted 10 in-depth interviews with individuals representing the sector.

While the study highlighted the need for swift action from the UK Government to manage the pandemic’s economic impact, it also confirmed the vital role of the Rail Sector Deal, set up in 2018 to build stronger partnerships between the sector and the government.

“While the impact of Covid-19 has clearly been felt right throughout the supply chain, our research reaffirms the importance of a strong working relationship between the rail sector and government as detailed in the Rail Sector Deal,” said RSG chair Philip Hoare.

“Our industry champions are already mobilised and planning how we might accelerate our work to help the sector bounce back and continue its transformation.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

The rail supply sector was severely impacted by the coronavirus pandemic, especially as regards to revenue

According to the inquiry, four in five organisations working in the sector noticed a decline in revenue, with 31% of respondents considering it significant. As for services and productivity, 27% and 18% respectively noticed a significant drop.

Qualitative findings also show that even when projects were allowed to carry on, productivity issues arose because of social distancing measures. Several individuals also aired their frustration at having projects, which could have been completed safely, deleted.

Other areas, including confidence in the supply chain and recruitment, were impacted less. 37% of companies registered zero impact on the supply chain while 41% said not to have been impacted during recruitment phases.

Measures have been adopted in different ways, depending on companies’ sizes

The research showed that 90% of respondents had their employees work from home, while 75% implemented 2-metre social distancing rules. More than 60% of companies have also applied for furlough schemes, while only 23% exercised other employment conditions including pay cuts and redundancies.

The data showed that larger organisations, employing more than 50 people, were more likely to adopt measures to reduce the outbreak’s economic impact.

Compared to 85% of companies with less than 50 employees, 98% of bigger companies implemented working from home solutions. As for applications to the UK Government’s furlough scheme, 76% of big companies applied, compared to 54% of smaller ones.

What has also emerged from the data is that the industry considered the furlough scheme to be essential in avoiding redundancies, as 52% of respondents considered non-essential work a key factor in the decision to furlough staff.

Confidence in surviving the crisis goes down with the passing of time

At the time of the survey, 82% of respondents were confident to be able to survive the crisis’s economic impact, with the majority, 55%, who said to be very confident.

The data, though, showed that overall levels of confidence tended to go down if respondents believed the impact of Covid-19 would continue for another year.

The overall lack of confidence grew from 3% to 48%, with one respondent saying: “If we find ourselves into September, October and projects are still slow to mobilise and new projects are slow to be awarded, then you become less confident the longer it goes on.”

Short and long term recovery plans

Sufficient cash flow for companies is considered the most important area for both short and long term plans.

According to the study, 31% of respondents consider securing cash flow to be the most important plan to implement in the long term, while 29% of them believe cash flow is needed now.

Companies have highlighted the importance of contracts and payments to be honoured, with many asking for invoices to be paid within shorter time frames.

“We need jobs to be honoured, not to be cancelled last minute. We are keeping key workers off furlough to service the client’s needs but they keep cancelling jobs,” said one respondent.

“[We need] for larger companies to make payments within seven days to SMEs and not force us to a 60-day contract,” added another.

Companies also want to see an acceleration of the publication of short and long term timelines, detailing what type of works will be commissioned and when.

“We need to understand all clients’ availability, funding and appetite to complete works and invest in projects, so we can ensure that financial targets can be re-forecasted and set accordingly. If we do not have enough investment in projects then we will need to reassess staffing levels and furloughed staff,” commented another respondent working in the professional services and construction sector.