Morocco’s National Office of Railways (ONCF) has announced a tender for the acquisition of 168 trains, marking a major step in the country’s preparation for the 2030 World Cup.

The deal, worth approximately AED16bn ($1.59bn), includes 150 trains between Intercity, Rapid Shuttle and Mass Transit Services, and 18 trains to extend the use of existing high-speed lines.

This includes an expansion of the Al-Boraq line that Morocco launched in 2018. Hailed as Africa’s first-ever high-speed railway, Al Boraq connects Casablanca to the northern port hub of Tangier, Morocco’s so-called ‘gateway to Europe’ situated a one-hour ferry ride from Tarifa in southern Spain.

The World Cup imperative

FIFA’s decision to name Morocco, Spain and Portugal as joint hosts of the 2030 World Cup but award Argentina, Uruguay and Paraguay the opening three matches has led to criticism from climate groups over the long-distance, high-emissions journeys teams will undertake between matches.

There has also been scrutiny over the readiness of Morocco’s transport system.

Morocco passed FIFA’s inspection in its initial bid for the 2026 World Cup but was deemed “high risk” in the accommodation and transport category.

“The amount of new infrastructure required for the Morocco 2026 bid to become reality cannot be overstated,” the report states. “The frequency of trains on the high-speed lines remains low (although the bidder has confirmed plans to increase this).”

Such criticisms are part of FIFA’s rationale for delaying Morocco’s hosting bid to the 2030 World Cup – and for Morocco’s recent flurry of transport activity.

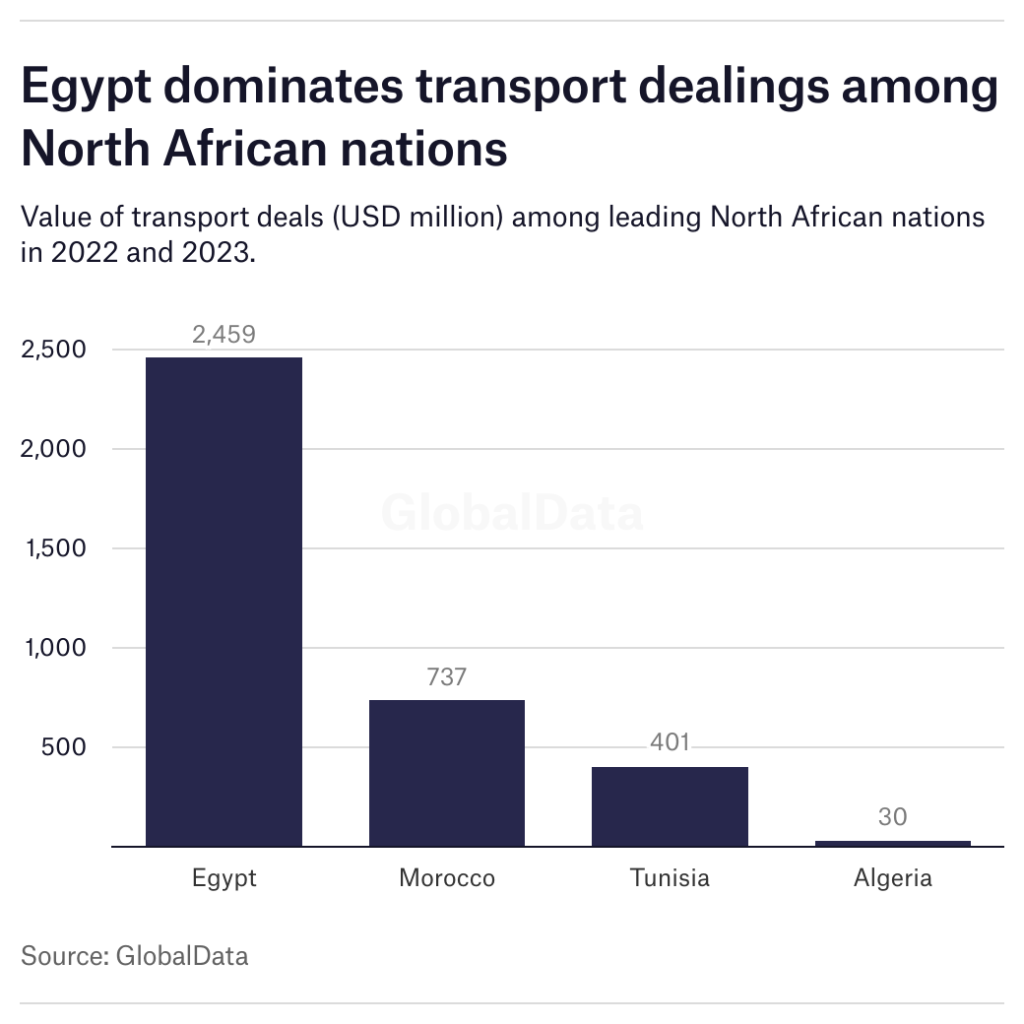

In 2022 and 2023, Morocco completed 12 transport deals worth $737m, making it the second most active Northern African country in the sector, according to GlobalData analytics.

An underground submarine connection between Morocco and Spain could begin in 2030, according to a report from Spanish outlet La Razón. The Gibraltar Strait Tunnel project intends to link Casablanca to Madrid.

Morocco aims to rival Egypt's rail network

Only Egypt accounts for a larger share of transport deals in the North African region than Morocco.

Egypt’s National Authority for Tunnels (NAT) is currently overseeing construction of a 1,800km high-speed rail network connecting roughly 70 stations from the Red Sea to the Mediterranean.

The first segment of the so-called ‘Suez Canal on tracks’ is expected to be completed by 2027, according to the NAT. The second segment, which has been extended to Egypt’s Western Desert, is underway but has no announced end date.

In February, the NAT awarded French construction company NGE the contract for 330km of double track between the cities of Ain Al Sokhna and Borg El Arab.

Through this, Cairo aims to extend its already widespread railway system, second only in size to South Africa in the continent.

Algeria to launch 6,000km Chinese-funded rail network

Morocco, Egypt, Tunisia and Algeria are all part of China’s extensive Belt and Road Initiative (BRI).

Beijing’s global infrastructure strategy, which spans more than 150 countries, has only invested approximately $1.6bn into Morocco, a minimal amount compared to other North African nations.

“China views Algeria as a gateway to Africa,” said Algerian MP Said Hamsi, Africa News reported. “It’s a win-win partnership for both sides. This is the spirit of the Belt and Road Initiative and Algeria's development plan. Algeria views China as a trusted partner.”

Tunisia, meanwhile, has made strides to catch up with Morocco in railway connectivity. The Tunis Rapid Rail Network (RFR), the country’s first electrified suburban railway line, took on its first passengers in April 2023, marking the end of a 13-year project.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.